Annual membership dinner drew many high bids for Cobblestone Museum

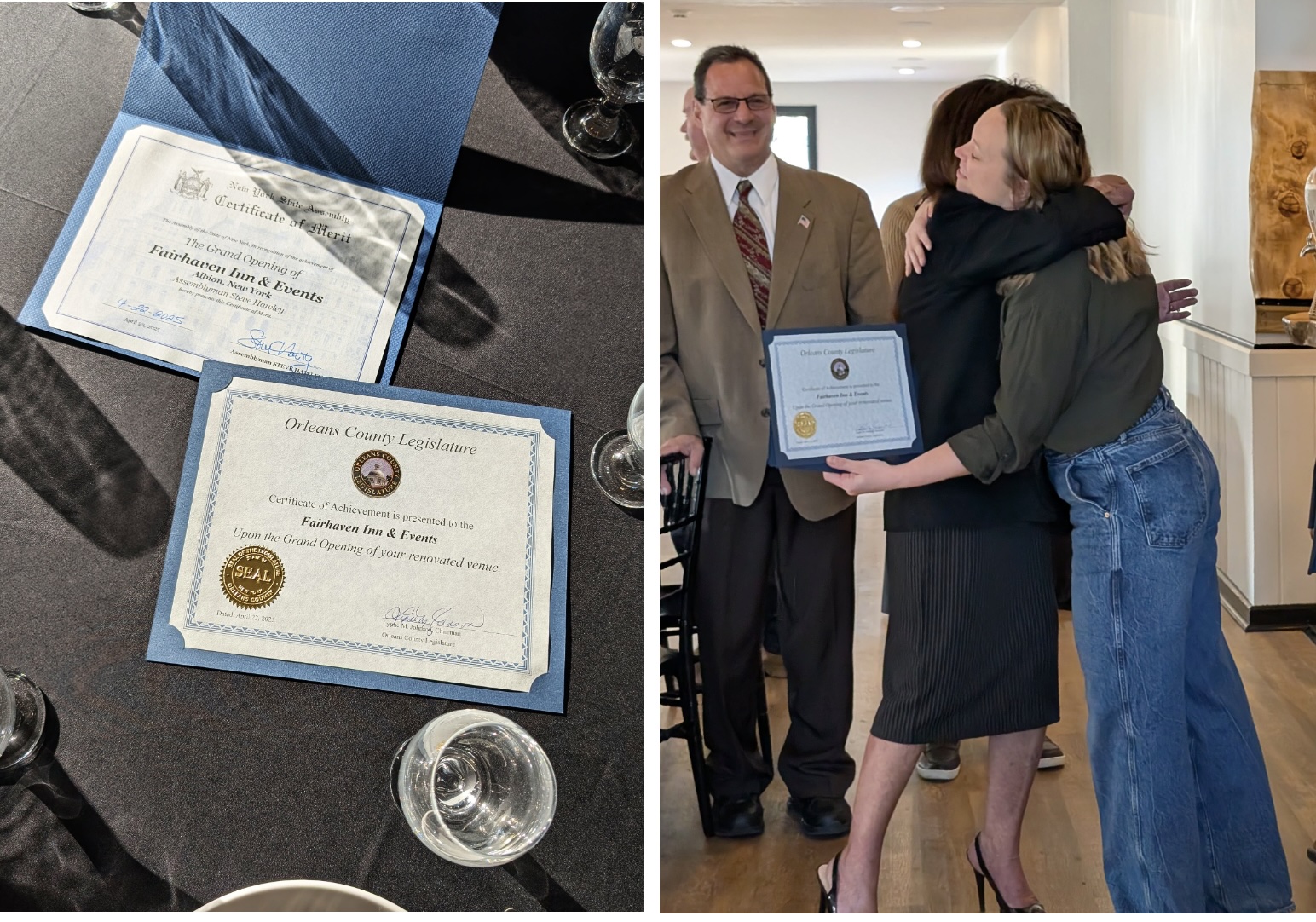

Photos by Ginny Kropf: From left, Gail Johnson, chair of the Cobblestone Museum’s annual membership dinner and Museum chair Doug Farley, draw winners of the Early Bird raffle. Jackson Hair, right, who is visiting from Arizona with his family, won a Tops gift certificate.

CARLTON – The Cobblestone Society’s annual fundraising dinner Wednesday night at the Carlton Firemen’s Recreation Hall will certainly be one for the record books.

In addition to a good attendance and successful auctions and raffles, Cobblestone Museum director Doug Farley welcomed guests and told them to expect a very good announcement soon from the Governor’s office. Farley has now confirmed the Cobblestone Society has been awarded a $716,000 Capital Improvement Grant for Arts and Culture through the New York State Council on the Arts’ Capital Projects Fund.

“This grant is really good news for the Museum,” Farley said. “It’s the final piece to the puzzle that will allow us to put a shovel in the ground and move forward this summer. We are incredibly thankful for all who contributed to this success.”

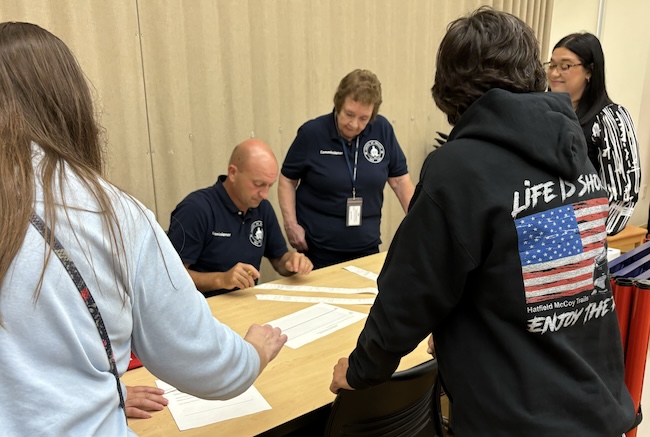

Former Orleans County Sheriff Randy Bower was auctioneer for the evening, shown here bidding on an item himself. In the rear, waiting to tally bids, are Chris Capurso and Gail Johnson, with master of ceremonies Larry Albanese.

The Cobblestone Society recently completed a successful fundraising campaign to purchase a historic home across the street from the Cobblestone Museum with plans to turn it into a visitor’s center.

Wednesday night’s dinner was the seventh annual Membership Fundraising Dinner for the Cobblestone Society. The evening featured a live auction with Randy Bower as auctioneer, a silent auction, raffles and dinner catered by Zambistro. Larry Albanese served as master of ceremonies for the evening.

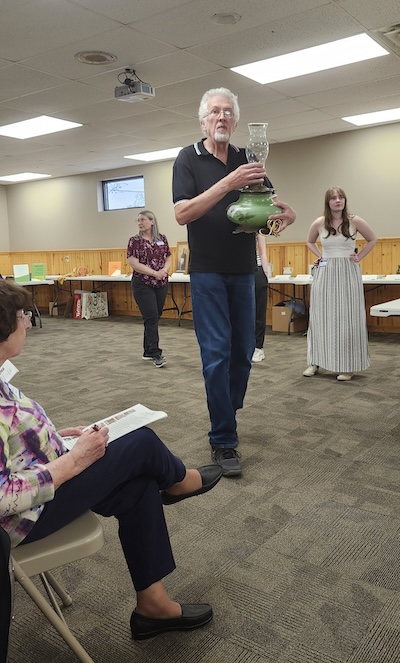

Marty Taber shows the crowd an electrified gas lamp which was donated to the live auction.

Main event was the live auction, in which Bower, who retired as sheriff of Orleans County, fired up the crowd to bring out the highest bids, sometimes bidding himself to raise the prices.

Twenty-one items were donated for the live auction, in which a Beehive Clock, circa 1870 and donated by Russ Bosch of Clarendon brought a record $600.

An American Barn Star quilt, made and donated by Brenda Radzinski, sold for $520.

A popular item, a specialty luncheon for 10 at the Cobblestone’s historic Vagg House, was bid up to $390, which Farley duplicated when two bidders expressed interest.

Five prizes were raffled off to ticket holders who made their purchase on or before March 31.

A popular raffle prize annually is a lottery tree donated by Shirley Bright-Neeper of Medina.

Numerous other donations from community members and local businesses covered the cost of the dinners, hall rental, appetizers, sheet cake and table coverings.

The public is reminded to support upcoming events to benefit the Cobblestone Museum. These include the Potty tour of outhouses on Saturday; Orleans County Bicentennial Museum Day on Sunday; Museum tours beginning Sunday through Oct. 31; a masonry workshop at 10 a.m. Sunday;

Progressive Organ Concert on June 1; Patriotic Service at the Cobblestone Church at 11 a.m. July 6; a Mid-Summer Celebration (formerly the Summer Solstice Soiree) at the gardens of Jeanette Riley of Albion; Fall Open House Sept. 6; Preservation Awards Banquet Oct. 10; Tour of Historic Homes Oct. 18; annual meeting Nov. 1; and “Simply Christmas” Dec. 6 at the Cobblestone Church.

More information on any events is available on the Cobblestone Museum’s website or by calling (585) 589-9013.

This quilt, held by Marty Taber and Mollie Radzinski, sold for $520. The quilt was handmade by Radzinski’s mother Brenda.