Orleans highest in effective property tax rate among NY counties

3.40% property tax rate more than double state average of 1.62%

Source: SmartAsset

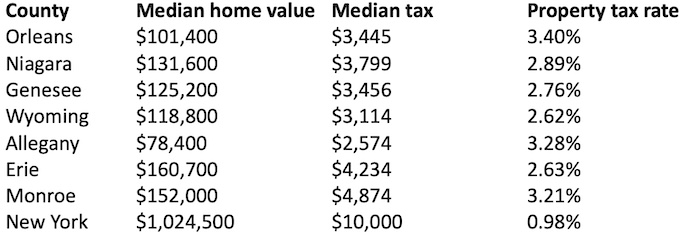

In Orleans County, property owners pay the highest effective tax rate among all 62 counties in the state, according to a ranking by SmartAsset, a financial technology company that publishes articles and guides about personal finance.

In Orleans, the average effective tax rate is 3.40 percent, more than double the state average of 1.62 percent. That rate is determined by taking the median annual property tax payment of $3,445 and dividing that by the median home value of $101,400.

Other nearby counties are close to the 3.40 percent effective property tax rate in Orleans. Monroe is at 3.21 percent, with Genesee at 2.76, Niagara at 2.89 percent and Erie at 2.63 percent.

In Orleans, the median property tax isn’t that high compared to other counties, and is lower than some of its counterparts. The primary driver for Orleans having the highest effective property tax rate are low property values compared to the other counties.

The $3,445 median property tax in Orleans is much lower than the $4,874 median in Monroe. However, Monroe has a median home value of $152,000 – about $50,000 higher than in Orleans.

The Orleans median annual property tax bill of $3,445 is very close to the $3,456 median in Genesee County, the $3,654 median in Livingston and $3,114 median in Wyoming County. Those are the four rural GLOW counties.

Orleans tops them with the highest effective tax rate because of the lower median home value. The $101,400 median in Orleans compares to $125,200 in Genesee, $134,000 in Livingston and $118,800 in Wyoming.

The $101,400 is among the lowest in the state. In Western New York, the values are lower in Allegany at $78,400, Cattaraugus at $90,200 and Chautauqua at $92,900. The property taxes, however, are also lower in those counties compared to Orleans with Allegany at $2,574 (3.28 percent rate), Cattaraugus at $2,665 (2.95 percent rate) and Chautauqua at $2,622 (2.82 percent rate).

New York City has the lowest effective property tax rate at 0.98 percent, but the median property tax bill is also the highest at $10,000, according to SmartAsset. However, the median home value is $1,024,500 – about 10 times the value in Orleans County.