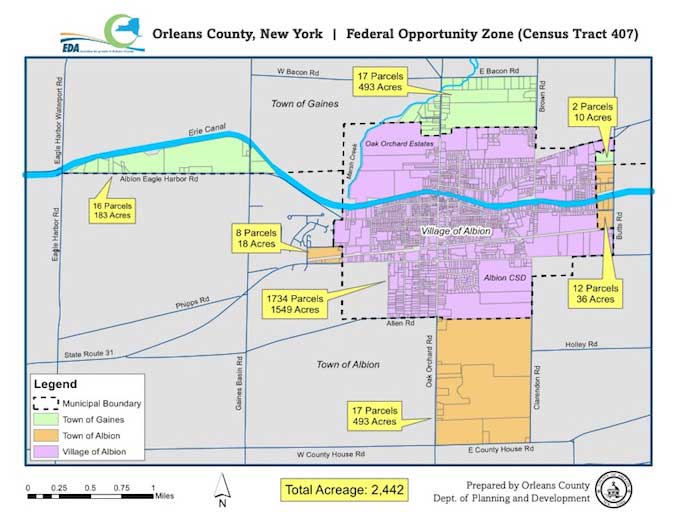

Nearly 2,500 acres in Albion, Gaines included in Opportunity Zone

This map was prepared for the Orleans Economic Development Agency by the Orleans County Department of Planning and Development.

Press Release, Orleans Economic Development Agency

ALBION – The Orleans County Economic Development Agency has announced a census tract in Orleans County has been designated as a Federal Opportunity Zone by the U.S. Department of the Treasury. The tract, totaling 2,442 acres, includes the village of Albion and parts of the towns of Albion and Gaines.

“This Opportunity Zone is a welcome designation for the central part of the county,” said Jim Whipple, chief executive officer of the Orleans EDA. “The tax benefits give us new tools to attract potential investment here in areas that are particularly suited for more real estate, retail, commercial and cultural development.”

Opportunity Zones (O-Zones) were added to the tax code by the Tax Cuts and Jobs Act on Dec. 22, 2017. An O-Zone is a low-income census tract with an individual poverty rate of at least 20 percent and median family income no greater than 80 percent of the area median.

As an economic development tool, the zones are designed to spur economic development and job creation in distressed communities by providing tax benefits to investors.

“I am very excited about the possibilities for community investment represented by the Federal Opportunity Zone in Orleans County,” said Lynne Johnson, chairwoman of Orleans County Legislature. “Investors will be able to access the extraordinary tax benefits offered by the program by investing in business and reals estate in our own backyard.”

Under certain conditions, investments in O-Zones may be eligible for preferential tax treatment. Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or Dec. 31, 2026.

If the QOF investment is held for longer than 5 years, there is a 10 percent exclusion of the deferred gain. If held for more than 7 years, the 10 percent becomes 15 percent. If the investor holds the investment in the Opportunity Fund for at least 10 years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.

Individuals can get the tax benefits, even if they don’t live, work or have a business in an opportunity zone. They can invest a recognized gain in a Qualified Opportunity Fund and elect to defer the tax on that gain.

“With over 1,700 parcels in Albion’s village included in the Opportunity Zone, we look forward to working with eligible project developers,” said Eileen Banker, mayor of the Village of Albion.

“The designation of a portion of the Town of Gaines selected as an Opportunity Zone opens the door for investment here,” said Joe Grube, Gaines town supervisor. “The creation of housing or small businesses can help the Town of Gaines by increasing the tax base and bringing new employment opportunities to the area.”