Murray OKs expanded income levels for seniors, disabled to receive breaks on taxes

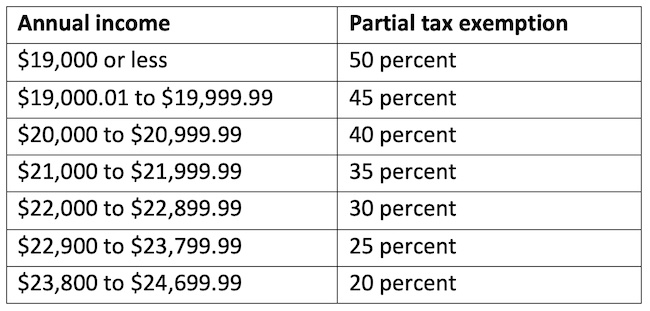

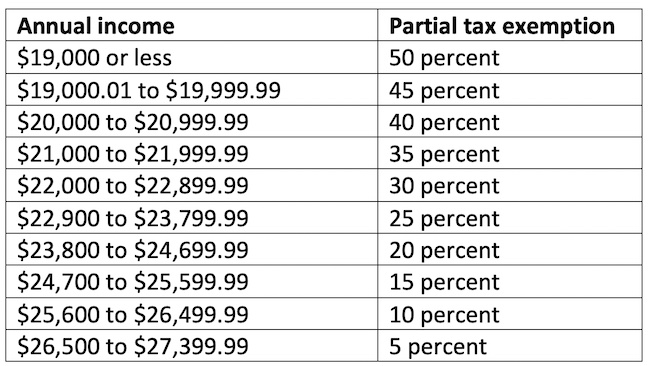

This chart shows the new senior citizen income levels and the percent of the property tax discount.

MURRAY – The Murray Town Board on Monday voted to raise the eligible income levels for both senior citizens and disabled property owners younger than 65 to receive a break on their property taxes.

The town followed the Orleans County Legislature which last week approved the higher income levels for the seniors and disabled to receive a discount on their taxes.

Like the county, Murray’s senior exemption previously gave 50 percent off property taxes for those 65 and older with an annual income at $15,500 or less.

The new exemption levels offer 50 percent off at annual incomes of $19,000 or less. It then drops in 5 percent increments until bottoming out at 20 percent off between $23,800 and $24,699.99.

This chart shows the new low-income disabled resident income levels and the percent of the property tax discount. Low-income disabled residents will switch to the senior citizen tax exemption once they are 65.

Murray also expanded the income levels for low-income disabled residents. The maximum exemption used to be at incomes $15,500 or below. Now it’s up to $19,000 for 50 percent off. That exemption then drops 5 percent before the lowest level of 5 percent off at incomes between $26,500 and $27,399.99.

The exemptions take effect in the 2024 tax bills. Applications for the exemptions are due by March 1.

Property owners can go through the town assessor to apply for the exemption.

Gerald Rightmyer signs the oath of the office as a new member of the Murray Town Board. Town Clerk Cindy Oliver administers the oath. Rightmyer resigned from the Zoning Board of Appeals to take the position on the Town Board, filling a vacancy created when Paul Hendel resigned. Rightmyer was appointed unanimously by the board to fill a term ending Dec. 31, 2023.