Kendall sets school tax rates, which vary from $10.51 to $17.36

KENDALL – The Board of Education has approved the school tax warrant which sets the tax rates among the five towns that are included in the district.

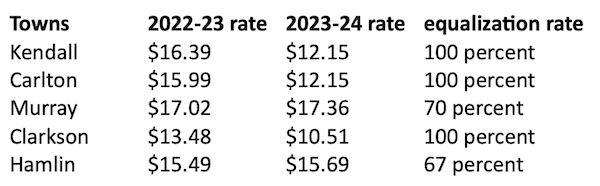

The rates vary from a low of $10.51 in Clarkson to a high of $17.36 in Murray. Other rates include $12.15 in Carlton and Kendall, and $15.69 in Hamlin.

Clarkson, Kendall and Carlton are all at 100 percent full value after doing town-wide reassessments. That has resulted in much lower tax rates this school year.

A year ago, the rates for those towns included Carlton at $15.99, Kendall at $16.39 and Clarkson at $13.48.

Clarkson is in Monroe County, and Monroe County shares some of the local sales tax with school districts. That resulted in $150,000 being directed to the Kendall school district to lower the school property taxes in Hamlin and Clarkson.

Orleans County used to share some of the local sales tax with school districts but that ended about 25 years ago.

Kendall has a $20,413,805 overall school budget for 2023-24. Property taxes through the tax levy remain unchanged at $4,964,656.

The district’s full property value totals $420,902,818. Clarkson represents 0.52 percent at $2,199,479; Murray is 11.58 percent at $48,758,819; Carlton is 12.98 percent at $54,627,942; Hamlin is 21.20 percent at $89,247,870; and Kendall is 53.71 percent at $226,068,708.