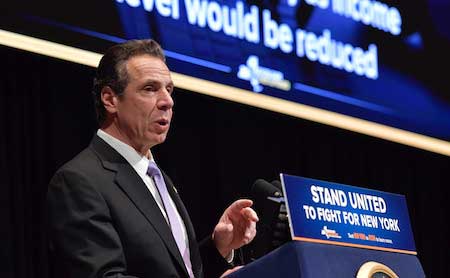

Governor proposes $168 billion budget that tackles ‘unprecedented challenges’

Proposes 3% percent increase for schools, while Excelsior Program eligibility expanded

Photo from Governor’s office: Gov. Andrew Cuomo outlines his executive budget today in Albany.

Governor Andrew M. Cuomo today unveiled the FY 2019 Executive Budget, which he said includes a number of proposals – fighting the federal tax assault to ending the opioid epidemic by holding pharmaceutical companies accountable to investing record amounts in education.

“For the past eight years, we have restored fiscal discipline while achieving historic progressive accomplishments and strengthening middle class New Yorkers,” Cuomo said. “Together, we will continue to deliver on the promise of progressive government – even while tackling unprecedented challenges head on. We will restore citizen confidence and ensure management competence. This bold agenda charts a path forward toward a better future for all New Yorkers.”

Highlights of the FY 2019 Executive Budget:

• State Operating Funds spending is $100.0B – an increase of 1.9 percent (State Operating Funds exclude Federal funds and capital)

• All Funds spending $168.2 billion for FY 2019

• Protects New Yorkers from federal tax assault

• Closes carried interest loophole

• Increases School Aid by $769 million – doubling the statutory School Aid growth cap and bringing total investment to $26.4 Billion

• Provides $7.5 billion in State support for higher education in New York- an increase of $1.4 billion or 24 percent since FY 2012

• Provides $118 Million to continue the successful Excelsior Scholarship and extend the income cap to $110,000

• Establishes a new opioid epidemic surcharge

• Imposes a Healthcare Insurance Windfall Profit Fee

• Defers Large Corporate Tax Credits

• Continues the phase-in of the Middle Class Tax Cut for six million New Yorkers – saving households $250 on average and $700 annually when fully effective.

For 8th straight year, spending limits spending growth to 2 percent

For the eighth consecutive year, the Budget is balanced and limits spending growth to two percent – a record of spending restraint unparalleled in State history.

The Executive Budget holds annual spending growth in State Operating Funds to 1.9 percent.

Protect New Yorkers from Federal tax changes

The recently enacted federal tax law is an assault on New York, Cuomo said. By gutting the deductibility of state and local taxes, the law effectively raises middle class families’ property and state income taxes by 20 to 25 percent. New York is fighting back against the federal plan and the loss of both income tax deductibility and property tax deductibility.

First, New York will challenge this unprecedented federal double taxation in court as unconstitutional, because it violates states’ rights and the principle of equal protection. Second, New York will lead the nation’s resistance to the new law, starting a repeal-and-replace effort: “Tax Fairness for All” campaign.

Third, at Governor Cuomo’s direction, the Department of Taxation and Finance is exploring restructuring options and issuing a preliminary report to outline options for State tax reform in response to the Federal legislation. The preliminary report is expected to outline a series of proposals for consideration and comment, including the potential to create additional opportunities for charitable contributions to New York State, the possibility of reducing income taxes by shifting income tax from an employee paid system to an employer paid system, and the option to add tax deductibility through a new statewide unincorporated business tax, among other options.

As New York launches this massive and complicated undertaking, the state will engage tax experts, both houses of the legislature, employers, and other stakeholders in a thorough and collaborative process to produce a proposal that promotes fairness for New York’s taxpayers and safeguards the competitiveness of New York’s economy.

Investing in Education

The FY 2019 Executive Budget includes a $769 million annual increase in School Aid — doubling the statutory School Aid growth cap and increasing education aid 35 percent since 2012. The Budget includes support for several key initiatives, including the Governor’s sixth consecutive investment in high-quality prekindergarten, a second round of Empire State After School awards to high-need districts, the continued transformation of high-need schools into community hubs, the largest State investment ever in computer science and engineering programming and instruction, and additional funding for early college high schools.

Expanding Access to Higher Education

The FY 2019 Executive Budget expands access to higher education by launching the second phase of the first-in-the-nation Excelsior Scholarship program, advancing a comprehensive plan to combat exploding student loan debt, and passing the DREAM Act. The Budget also includes strategic investments that will ensure no student goes hungry on college campuses and provide New Yorkers with the tools and skills they need in the 21st century economy.

The Excelsior Free Tuition Program will see the income eligibility threshold increase, allowing New Yorkers with household incomes up to $110,000 to be eligible. To continue this landmark program, the budget includes $118 million to support an estimated 27,000 students in the Excelsior program. Along with other sources of tuition assistance, including the generous New York State Tuition Assistance Program, the Excelsior Scholarship will allow approximately 53 percent of full-time SUNY and CUNY in-state students, or more than 210,000 New York residents, to attend college tuition-free when fully phased in.

Protecting the Health & Safety of Our Communities

Governor Cuomo is committed to expanding access to quality and affordable health care for all New Yorkers. From redesigning Medicaid to reduce costs and improve care, to embracing the Affordable Care Act and enrolling nearly one in five New Yorkers through the state’s marketplace, Governor Cuomo has transformed health care in New York State. This year, New York will continue to expand access to affordable and quality health care across the State while tackling the major health challenges facing our communities.

• Establish an Opioid Epidemic Surcharge: New York State, like much of the country, is battling a harrowing opioid epidemic. The Executive Budget imposes a new surcharge of 2 cents per milligram of active opioid ingredient on prescription drugs, directing all proceeds to the Opioid Prevention and Rehabilitation Fund. This new fund will expand prevention, treatment, and recovery services, with the express goal of cutting opioid-related deaths in half by 2021.

• Preserving the Children’s Health Insurance Program: Congress has yet to pass long-term funding for CHIP, which directs Federal support to Child Health Plus, a successful program that has provided health coverage to approximately 350,000 children in New York State. Should funding be allowed to lapse for the program many of these children may lose health insurance coverage. The FY 2018 Budget authorizes program modifications, if necessary, to preserve CHIP.

• Establish a Health Care Insurance Windfall Profit Fee: The Federal tax plan gives health insurers a 40 percent cut on their corporate taxes while also transferring health care costs to the State. Accordingly, the Budget imposes a 14 percent surcharge on health insurer gains to recapture $140 million of those corporate tax savings and reinvest it in vital health care services for New Yorkers.

• Support Direct Care Workers and Not-for-Profits: The Budget includes funding of $262 million, an annual increase of $237 million, to support the 6.5 percent salary increase provided to direct care professionals (3.25 percent in January 1, 2018 and 3.25 percent in April 1, 2018) as well as the April 1, 2018 3.25 percent salary increase for clinical workers employed by not-for-profit organizations rendering mental hygiene services on behalf of OPWDD, OMH or OASAS.

Driving Economic Growth & Development

The Executive Budget continue the 10 Regional Economic Development Councils. In 2011, Governor Cuomo established 10 Regional Economic Development Councils (REDCs) to develop long-term regional strategic economic development plans. Since then, the REDCs have awarded $5.4 billion to more than 6,300 projects. This strategy has resulted in 220,000 new or retained jobs in New York. The Executive Budget includes core capital and tax-credit funding that will be combined with a wide range of existing agency programs for an eighth round of REDC awards totaling $750 million.

• Launch Next Round of the Downtown Revitalization Initiative: The Downtown Revitalization Initiative is transforming downtown neighborhoods into vibrant communities where the next generation of New Yorkers will want to live, work and raise families. Participating communities are nominated by the State’s ten REDCs based on the downtown’s potential for transformation. Through two rounds of awards, each winning community was awarded $10 million to develop a downtown strategic investment plan and implement key catalytic projects that advance the community’s vision for revitalization. The FY 2019 Executive Budget provides $100 million for the Downtown Revitalization Program Round III.

To see more on the budget proposal, click here.