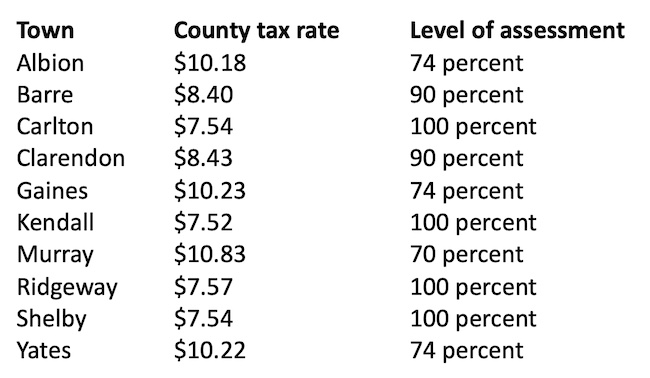

County tax rates vary by more than $3 among 10 towns

Rates higher in towns that haven’t done reassessments

Orleans Hub chart with data from the Orleans County Real Property Tax Services and the NYS Office of Real Property Tax Services.

ALBION – The tax bills arriving for property owners around Orleans County have varying tax rates due to the towns not all doing town-wide reassessments the same year.

The towns used to do reassessments every three years, except in Barre which did a re-evaluation every year.

But only four of the 10 towns did an updated reassessment in 2023. Carlton, Kendall, Ridgeway and Shelby all are at 100 percent valuation and their county tax rates range from $7.52 to $7.57 per $1,000 of assessed property. (The county budget for 2024 increases the tax levy by 3.25 percent.)

Some of the towns are at least four years from their last town-wide reassessment. Murray is only at 70 percent of market value and that town has the highest county tax rate at $10.83 after the equalization rate is factored in.

The state imposes the equalization rates so towns that aren’t at full valuation are paying their fair share in property taxes.

Albion, Gaines and Yates are at 74 percent value and they pay tax rates from $10.18 to $10.23. Barre and Clarendon, which did reassessments in 2022, are at 90 percent value and they pay county tax rates of $8.40 in Barre and $8.43 in Clarendon.

Some of the towns have held off on town-wide re-evaluations to see if a hot real estate market would slow down. But the prices haven’t cooled off. Some of the towns also have new assessors and have put off the ambitious task of re-evaluating 2,000 to 3,000 properties.