County passes $78 million budget that tackles more projects, stays under tax cap

Legislator Allport opposes 1.9% tax increase, saying growth in sales tax gives county a cushion

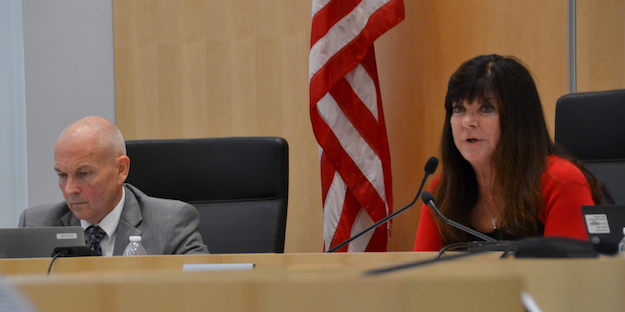

Photos by Tom Rivers: Legislature Chairwoman Lynne Johnson said the budget keeps the county moving forward, addressing many needs while maintaining services. She worries about possible state cuts in the future that would strain the county budget. Jack Welch, left, is the chief administrative officer.

ALBION – The Orleans County Legislature has passed a $78 million budget that takes on more capital projects and restores some previously eliminated positions while staying under the tax cap.

The budget increases taxes by 1.9 percent and increases the tax rate from $9.98 to $10.09 per $1,000 of assessed property.

County Legislator Don Allport

One legislator, Don Allport of Gaines, opposed the spending plan because he said the county has collected about $1 million more than expected in sales tax this year and that increase could easily wipe out the $347,503 tax levy increase.

He said residents are feeling a financial pinch from inflation. That is particularly difficult for people on fixed incomes who are paying more for gas, fuel and other services.

He said the “astronomical” housing sales in the past year will likely result in higher property assessments – and tax bills.

“I think it’s critical we have a 0 percent increase,” Allport said during the budget vote on Dec. 2. “That’s why I’m voting against this.”

Other legislators said they are concerned the state could cut back reimbursements to the county. During the height of the pandemic the state cut counties by 20 percent, a reduction that later adjusted to a 5 percent cut.

The state is facing big increases in Medicaid and education funding that will strain the state budget, said County Legislator Ken DeRoller. He worries the state will try to balance its budget by cutting reimbursements to local governments.

Legislator John DeFilipps said county leaders cut about $9 million from the budget as part of the process in putting the spending plan together.

“This is a fair budget,” he said. “It addresses put-off projects. We stepped up in repairs.”

Legislature Chairwoman Lynne Johnson praised Jack Welch, the county budget officer, and Kim DeFrank, the county treasurer, for their work with the budget.

“You put forth an amazing budget and I’m proud to support it,” Johnson said.

Although sales tax is up, Johnson said some other revenue is down or uncertain.

She also commended the department heads for their budget proposals.

“You didn’t come in with a Dear Santa letter,” she said. “You came to us with your actual needs.”

Welch went over the budget during a hearing last week. He highlighted the county will add five positions that will be funded with federal American Rescue Plan Act money including a public safety dispatcher, criminal investigator, building maintenance worker, deputy director of computer services and senior computer specialist.

About $2.20 of the $10.09 rate is support for towns and villages in the county, including prosecution of vehicle and traffic offenses, AIM-related payments, a sales tax distribution of $1,366,671 and $2,050,000 in community college chargebacks.

SALES TAX DIVERSION – Even though the sales tax is up significantly, mainly due to taxes collected on line sales, some of that is diverted by the state. The state last year started requiring the county to pay $290,000 of its sales tax in AIM payments to towns and villages that was paid by state. The state also takes $190,274 in the county sales tax and diverts it to “financially distressed health facilities” with no guarantee it will be used for that purpose, Welch said.

CAPITAL PROJECTS – The county is planning $4,470,000 in capital projects, which is up about $2 million from the $2,577,000 in 2021. Some of the projects for 2022 will be paid from federal ARPA including $630,000 in work on deferred maintenance projects, $325,000 for a fiber loop to increase connectivity among county’s computer/IT network, and $170,000 for work on the county’s fuel farm on West Academy Street by the DPW.

State CHIPS funding will pay $1,285,000 for highway reconstruction with $125,000 in local funds going to culvert and bridge repairs, $125,000 to patch and seal county roads, and $200,000 in local funds for general repairs to the 50-year-old county jail. Federal and state funds will also pay $1.6 million for preventive maintenance on three bridges.

AGENCY FUNDING – For the third year the budget keeps the same level of funding for several agencies that provide services in the community: Cornell Cooperative Extension, $240,000; Orleans Economic Development Agency, $190,000; Soil & Water Conservation District, $92,500; four public libraries, $10,000 combined; Sportsmen’s Federation, $4,000; and Geneses-Orleans Regional Arts Council, $3,000. The Cobblestone Museum is in the budget as a line item but gets no county support.

MANDATES – The county is getting some relief in the nine mandated programs from the state, which consume 86 percent of the tax levy. The county’s Medicaid cost is down from $8,121,776 to $7,311,550 with the federal government picking up more of the cost. The county’s pension contribution also is down due to a better-performing stock market. The county’s contribution will go from $3,054,489 to $2,475,335.

Other mandated expenses with the 2021 budget numbers in parentheses include: Public Assistance/Safety Net, $1,787,937 ($1,802,337); Child Welfare/Protection, $1,528,322 ($1,336,399); Special Education, $983,529 ($971,931); Probation, $982,115 ($759,299); Indigent Defense, $511,307 ($536,053); Youth Detention, $302,650 ($302,650); and Early Intervention, $243,833 ($204,688).