County Leg approves $92 million budget with 3.25 percent tax increase

Kendall town supervisor urges Leg to cut more but chairwoman says budget ‘bare bones’

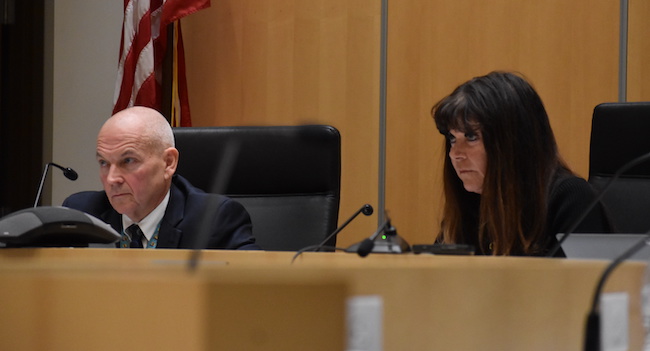

Photos by Tom Rivers: Orleans County Chief Administrative Officer Jack Welch and Legislature Chairwoman Lynne Johnson go over the county’s $92 million budget during a public hearing on Thursday.

ALBION – The Orleans County Legislature approved a $92,494,994 budget on Thursday in a 7-0 vote.

The budget increases the tax levy by 3.25 percent or by $607,000 to $19,264,000. The tax rate is going down by $1.30 from $9.87 to $8.57 per $1,000 of assessed property. However, property owners won’t all pay the same tax rates because not all towns are at 100 percent full valuation.

Four towns – Carlton, Kendall, Ridgeway and Shelby – completed town-wide reassessments in 2023 and are at full value. They will pay a lower tax rate for the 2024 county taxes.

Other towns – Albion, Gaines, Murray and Yates – haven’t done reassessments for several years and will pay a much higher tax rate. Barre and Clarendon were reassessed in 2022 and will have a higher rate than $8.57 but not as high as the four towns that are at least four years from their last town-wide re-evaluation.

The exact final rates aren’t set yet. The tax bills are to be mailed by Jan. 1.

County Legislature Chairwoman Lynne Johnson said the budget preserves county programs and stays within the tax cap despite more than $2 million being pushed on the county from the state.

“Budgets are all about dollars and cents,” Johnson said during the budget hearing. “But budgets are also about strategic priorities and long-term plans. We need to govern to meet immediate needs and demands, while investing in areas that foster growth and future opportunity.”

Three town supervisors – Sean Pogue of Barre, Richard Moy of Clarendon and Tony Cammarata of Kendall – attended the hearing and had questions for legislators.

Moy said residents ask him about the county recent acquisitions totaling $1,7250,000. He asked where that money came from and if it’s in the 2024 budget.

Jack Welch, the county chief administrative officer and budget officer, said the county was able to pay for the properties out of the reserves for the 2023 budget.

Moy said the county’s population is down about 2,500 to about 40,000 total. “And we keep buying new buildings.”

Johnson said the acquisitions weren’t new buildings, but vacant property that fills a need.

Three town supervisors – from left Sean Pogue of Barre, Richard Moy of Clarendon, and Tony Cammarata of Kendall – attended the budget hearing and had questions for the county legislators.

The Legislature on Oct. 24 approved spending $975,000 to acquire the former building used for Genesee Community College in Albion and 25.7 vacant acres adjacent to the property for $500,000. The county will move the Probation Department and District Attorney’s office out of the Public Safety Building and into the former GCC site.

The Public Safety Building has been the home for Probation, the DA’s Office, the Sheriff’s Office and the 911 dispatch center for the past 25 years. But that building has challenges, especially with a big flat roof.

In September the Legislature approved spending $250,000 for the former Bank of America site at 156 S. Main St. in Albion, which will become the treasurer’s office in 2024. That building has a drive-through and is more easily accessible than the current office on East Park Street, county officials said.

The current treasurer’s building at Central Hall “is a money trap for us,” Johnson said about continuing to invest in that property.

“We’ve kicked the can down the road so many years,” she said.

Pogue from Barre asked how much the county stands to gain in revenue from solar projects. There are currently four that will be online in 2024 and the county will collect $25,000 combined from all four. As more of the projects are complete and generating electricity, the county will collect more revenue, said Kathy Bogan, the county attorney. The projects generate $7,000 in revenue for local governments for each megawatt. That $7,000 is divvied up by thirds to the town the project is located in, the county and the school district.

Cammarata of Kendall said the 3.25 percent tax increase is high. He urged the Legislature to find more to cut in the budget or tap more money from its reserve.

“All I’m asking is you take another look at it,” Cammarata said. “I feel for the people of Orleans County. Look one more time and see if you can slice that down. The people are suffering. If you cut it, it sends a message to the people that you care about them.”

Johnson said legislators, department heads, Welch and county treasurer Kim DeFrank have worked in recent months to minimize the tax increase. She said the budget was “bare bones” and burdened by unfunded state mandates.

Welch said the mandated programs from the state are up about $2.2 million or 12.9 percent for nine mandates to $19,056,290. That includes Medicaid up 17.7 percent to $8,693,594; Pension costs up 3.2 percent to $3,041,025; Public assistance/Safety Net increase of 21.6 percent to $2,330,569; Child welfare/Protection up 21.5 percent to $2,193,962; Special education up 4.5 percent to $990,270; Probation increase of 9.6 percent to $779,651; Indigent defense up 36.6 percent to $700,834; Early intervention up 3.2 percent to $276,385; and Mental Health law expense, up 87.5 percent to $50,000.

The budget addresses several capital projects with the total for 2024 at $7,883,213 with the county cost at $3,525,358.

The projects include: $2,150,000 of highway reconstruction (100 percent funded by CHIPS), $1.5 million with bridge projects (3 for design and 1 replacement to be funded with federal TIP and state BridgeNY), $1.3 million of culvert and bridge repairs (local funds), $1,242,000 of patching and sealing county roads (local funds), $557,199 for DPW equipment (SHIPS and state SAM), $396,935 for software and technology (local funds), $265,686 for Buildings & Grounds projects (local funds), $200,000 for jail general repairs (local funds), $195,493 for vehicles and equipment for Sheriff’s Office (local funds), and $75,000 for emergency management vehicle (state and federal funds).

Welch said a homeless crisis for temporary and permanent emergency housing placements has increased the workload for the Department of Social Services. Assisting the homeless as well as other mandated programs through DSS prompted the county to increase the hours for DSS workers from 35 to 37.5 hours per week.

The county is hoping to have more county employees go from 35 to 37.5 hours in 2024. That will be a discussion with the unions.

Welch said the employees will be paid more for those extra hours, but the county will save money by not having to pay for more health insurance and benefits if more employees were hired.

The budget also increases the solid waste fee by $4 to $220 a year.

The county budget provides funding for other organizations in the county, with some slated to get an increase and others not.

The four public libraries will stay at $10,000. Mercy Flight stays at $5,000. The Cobblestone Museum will get $3,000. The organization hasn’t been a line item in the budget in recent years but sometimes received $3,000 from the county’s contingency funds.

The budget allocates $200,000 for the Economic Development Agency, up from $190,000 in 2023. The Soil & Water Conservation District goes from $95,000 in 2023 to $97,500.

The Sportsmen’s Federation sees its funding cut from $1,000 to $0.

The Cooperative Extension stays at $240,000, even though the organization requested $275,000. The Extension has been at $240,000 since at least 2020. The Genesee-Orleans Regional Arts Council remains at $4,000.

The county has an allowable growth rate in the tax cap of 3.76 percent for 2024, or $701,733, Welch said, noting the adopted budget stayed under that cap.