County expands income levels for seniors, disabled to receive tax discounts

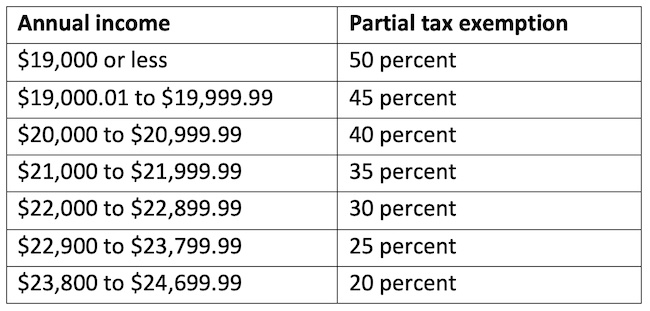

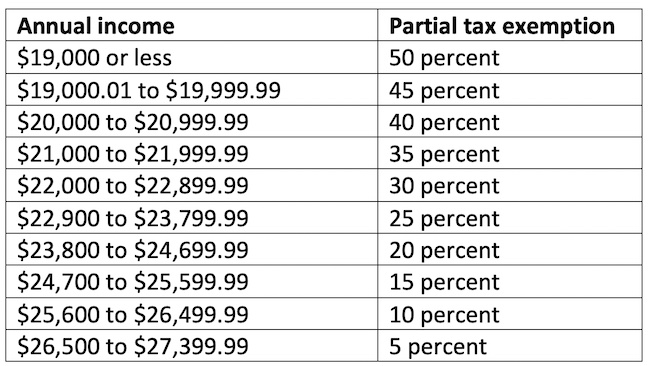

This chart shows the new senior citizen income levels and the percent of the property tax discount.

ALBION – The Orleans County Legislature has increased the income levels for senior citizens and disabled property owners to receive a break on their property taxes.The County Legislature on Wednesday approved higher income levels for senior citizens and disabled residents to get a tax reduction on their county tax bills. The senior exemption was last changed in 2014, while the low-income disabled exemptions were last modified in 2017.

The senior exemption previously gave 50 percent off property taxes for those 65 and older with an annual income at $15,500 or less and then dropped in 5 percent increments.

The new exemption levels offer 50 percent off at annual incomes of $19,000 or less. It then drops in 5 percent increments until bottoming out at 20 percent off between $23,800 and $24,699.99.

The county also expanded the income levels for low-income disabled residents. The county started offering that exemption in 2007. The maximum exemption was for incomes at $15,500 or below. Now it’s up to $19,000 for 50 percent off. That exemption then drops 5 percent before the lowest level of 5 percent off at incomes between $26,500 and 27,399.99.

This chart shows the new low-income disabled resident income levels and the percent of the property tax discount. Low-income disabled residents will switch to the senior citizen tax exemption once they are 65.

Dawn Allen, the county’s director of real property tax services, said most of the towns in the county are also looking to expand the income levels for seniors with their property tax exemptions.

The Town of Murray is currently the only town in the county offering the low-income disabled exemption, Allen said.

The county’s expanded income levels for exemptions will apply to assessment rolls prepared on taxable status dates occurring on and after March 1, 2023.