County clarifies income tax exemption levels, with money from investment funds included

ALBION – Orleans County has specified what counts as income for determining whether senior citizens and disabled property owners qualify for a property tax discount.

The State Legislature during the 2023-24 budget changed the definition of “income” for property tax discounts to give the option to not include money from IRAs and other investment accounts.

But Orleans County is keeping IRAs and the investment accounts as income in determining the eligibility. The county will go by the gross adjusted income for federal tax purposes. It has specified that distributions from individual retirement accounts or retirement annuities will be included.

Dawn Allen, the county’s director of real property tax services, said during a public hearing the intention of program is to help lower-income senior citizens and those with disabilities. To not include that income would significantly increase the number of people getting the partial tax exemption, shifting more of the tax burden to others, Allen said.

The County Legislature a year ago increased the income levels for senior citizens and disabled property owners to receive a break on their property taxes.

The senior exemption was previously last changed in 2014, while the low-income disabled exemptions were last modified in 2017.

The senior exemption previously gave 50 percent off property taxes for those 65 and older with an annual income at $15,500 or less and then dropped in 5 percent increments.

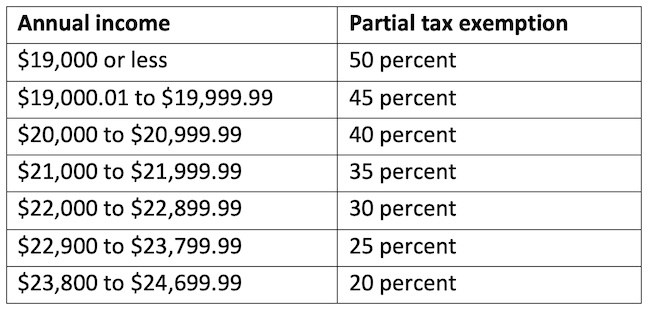

The exemption that took effect in 2023 offers 50 percent off at annual incomes of $19,000 or less. It then drops in 5 percent increments until bottoming out at 20 percent off between $23,800 and $24,699.99.

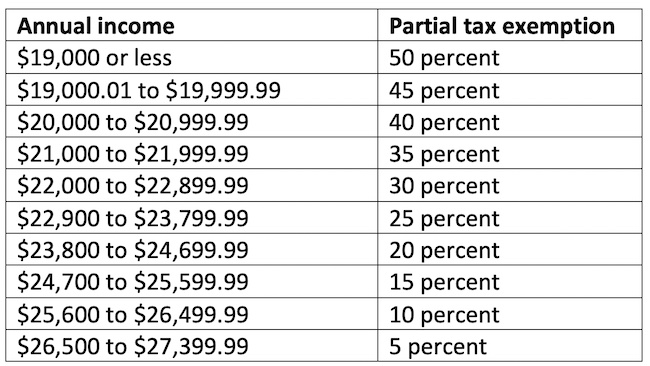

The county a year ago also expanded the income levels for low-income disabled residents, effective in 2023. The county started offering that exemption in 2007.

The maximum exemption was for incomes at $15,500 or below. Then it changed to $19,000 or less for 50 percent off. That exemption then drops 5 percent before the lowest level of 5 percent off at incomes between $26,500 and 27,399.99.