Clarendon hears concern from residents over rising assessments

Town officials say higher assessments don’t necessarily mean higher tax bills

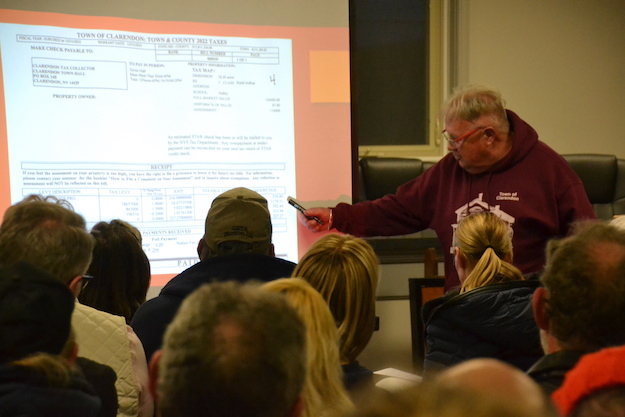

Photos by Tom Rivers: Town Supervisor Richard Moy met with about 100 residents on Wednesday evening to discuss the reassessments that just went out in the mail. The average assessment increased 25 percent from the values three years ago.

CLARENDON – About 100 residents packed the Town Hall on Wednesday evening to share their concerns that much higher assessments will result in bigger tax bills and drive some residents out of their homes.

Town officials acknowledged the real estate market is “crazy” with homes selling for tens of thousands of dollars above their assessed values. In Clarendon, there have been 146 sales over the past three years.

There are about 1,000 properties in the town. Clarendon does a reassessment every three years and 2022 is the cycle for reassessing the properties. Eight of the 10 towns in Orleans are doing reassessments this year.

In Clarendon, the average assessment increased 25 percent, Town Assessor Robert Criddle told the crowd at town hall.

Clarendon Town Assessor Robert Criddle meets with about 100 residents to discuss the new assessments for about 1,000 properties in Clarendon. Criddle said property owners can meet with him and a Board of Assessment Review if they believe the assessments are too high.

Criddle noted that the median price for homes in Orleans County is up 68.5 percent in four years, jumping from $81,000 in 2017 to $136,500 in 2021, according to data from the Greater Rochester Association of Realtors.

In Clarendon’s 14470 zip code, the median sale price went up 10.7 percent in 2021, Criddle said, using data from the Association of Realtors.

“The market has changed,” he said. “Right now the assessments are well below market value.”

The higher assessments won’t necessarily mean a bigger tax bill for residents, said Town Supervisor Richard Moy.

“We didn’t raise your taxes,” Moy told the crowd. “We raised your assessments.”

Richard Moy discusses how the tax base affects the tax rate. A higher overall town assessed value should result in a lower tax rate.

A larger tax base should drive down the tax rate. But that didn’t ease the concerns of many of the residents who attended the meeting on Wednesday.

Residents said they fear much higher tax bills and that will strain their budgets that are already hit with rising gas prices and inflation.

Town Assessor Robert Criddle said the real estate market is “crazy” right now but assessments need to reflect the current market values.

One resident said his assessment increased from $58,000 to $90,000 despite no improvements on the house.

“I’d be lucky to get 40 (thousand) for the place,” he said.

Criddle said those who don’t think their assessment accurately reflects market value can call assessor’s office at (585) 638-6371, ext. 103. They can question the value and can go through a grievance process. He encouraged them to do some research on comparable sales.

He acknowledged the shock with some the prices houses are going for – way above their assessed values.

“I’ve been doing this for 30 years,” Criddle said about his career as assessor. “The market has been crazy. There’s no question about it.”