Carlton residents share concerns over property reassessments up an average 40%

Higher values don’t necessarily mean more in taxes, real property director says

Photos by Tom Rivers: About 50 people attended an informational meeting on Monday evening at the Carlton Town Hall about the new reassessments for the town. Dawn Allen, left at dais, is the director of real property tax services for Orleans County. Lisa Ames, right, is the Carlton town assessor. They took questions from the public for about 1 ½ hours.

CARLTON – Many Carlton residents attended a meeting Monday evening and said their new reassessments don’t reflect reality, with the town assessor putting values that are on average 40 percent higher than the last re-valuations four years ago.

About 50 people were at the informational meeting where Assessor Lisa Ames and Dawn Allen, the Orleans County real property tax director, went over the reassessment process.

Allen acknowledged the values are way up in Orleans County.

Dawn Allen, the real property tax director for the county, said the reassessments have gone to reflect a dramatic change in the marketplace.

“We’re seeing some dramatic activity,” Allen said about sale prices way above assessments and asking prices.

Orleans is normally a very stable market with small incremental changes, she said.

But the housing prices soared during the Covid-19 pandemic, with more people working from home and many seeking life in the countryside. Interest rates were minuscule.

But residents say the market has changed this year, with much higher interest rates and a return to normalcy with the Covid pandemic no longer in the emergency stage.

One resident bought a house 2 ½ years ago and he said his new assessment in $116,000 more than what he paid for the house.

He said “fools” created a market bubble that he worries will come to a crash.

Allen said the data shows an across-the-board overall big increase in sale prices. It isn’t just a few isolated sales. Allen said the assessments need to reflect how homes are selling on the market.

Allen shared the median sale prices in Orleans County in recent years:

- 2018, 486 sales, $96,500 median

- 2019, 435 sales, $109,000 median

- 2020, 378 sales, $122,396 median

- 2021, 423 sales, $135,000 median

- 2022, 381 sales, $150,000 median

“We are seeing 15 to 20 percent jumps annually in the market,” Allen said.

Many towns opted against reassessments last year, wanting to wait a year to see if the market would slow down. Only Clarendon did the usual re-valuations in 2022, which are done every three years in the normal cycle among Orleans County towns, except Barre, which typically did town-wide reassessments every year.

Carlton, Kendall, Ridgeway and Shelby are doing the reassessments this year, at least four years since the last one.

Albion, Gaines, Murray and Yates aren’t doing them this year, meaning it will be five years without a reval if they do them next year. Just because they aren’t doing revals doesn’t mean those towns can ignore the rising market prices. The state uses equalization rates to try to make the tax rates fair. (Those towns that aren’t at 100 percent valuations will pay a higher equalization rate for the tax rates.)

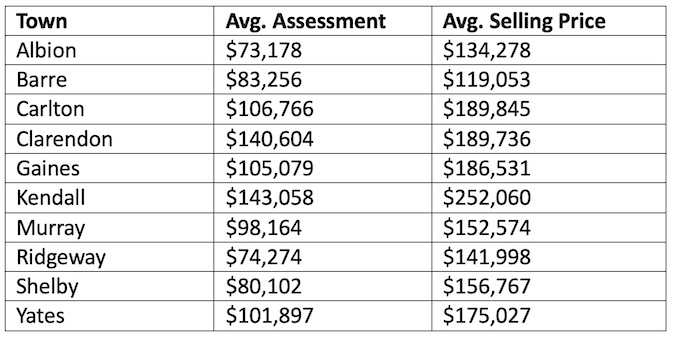

Source: Orleans County Real Property Tax Services

Allen said the reassessments don’t mean property owners will pay more in taxes. The tax levies will be divided by a bigger tax base, which should result in a lower tax rate. In Carlton, those whose assessments increased less than the 40 percent average would pay less in taxes. Those with assessments that went up more than 40 percent would see an increase, Allen noted.

Clarendon did a town-wide reassessment last year, the only town to do it among the 10 on the three-year cycle. Clarendon’s assessments were up an average of 30 percent.

The higher values resulted in a drop in the tax rate for Clarendon property owners, Allen said. The school tax rate in Holley for Clarendon property owners decreased from $24.10 per $1,000 assessed property in 2021 to $19.28 last September. Clarendon’s combined town and county tax rate was down from $15.70 in 2022 to $12.65 this year with the new values, Allen said.

She encouraged the concerned property owners to do their homework in researching comparable sales to determine the market value if they are going to challenge the new assessments. They should look for sales within their town, checking similar neighborhoods and housing sizes and styles. They can check the Orleans County Real Property Database (click here) or real estate websites such as HomeSteadNet or Zillow.

Some of the residents who spoke at Monday’s meeting said prices are already sliding down this year with higher interest rates. Allen said the market is still strong. The prices tend to be a little lower the first quarter during the winter and then gain strength, she said.

However, if the prices overall are lower, the next reassessments in Carlton in three years will reflect the change in the market. (The values in the new Carlton assessments are based on the market price as of July 1, 2022. The next reassessment, if the town stays on a three-year cycle, will be based on the values of properties on July 1, 2025.)

“It’s too early to predict,” Allen said. “If they go backwards, then the (assessments) will have to go backwards.”