NY Farm Bureau says ag census shows concerning loss of farmland

In 5 years, NY down 364,000 acres of farmland and 2,800 farms

Photo by Tom Rivers: A farmer harvests soybeans on East Barre Road in Barre on Oct. 13, 2019.

Press Release, NY Farm Bureau

The U.S. Department of Agriculture released its 2022 Agriculture Census revealing a cause of concern for New York agriculture.

While 98-percent of farms remain family owned in the state, the overall number of farms declined by nearly 2,800. That is about a 9 percent drop from the previous 2017 Agriculture Census and the steepest decline in the past three decades. The state also lost 364,000 acres of farmland over the past five years.

A significant portion of the decline is in dairy farming, the largest commodity value in New York State. New York saw a decrease of nearly 1,900 dairy farms, though the total number of dairy cows slightly increased. This reflects the market consolidation that has been happening in the industry. Others that also saw losses include vegetable, berry and organic farms.

The census did reveal some bright spots, including an increase in the number of orchards as well as oyster producers. Market value also rose significantly, topping $8 billion. This is in large part due to temporary increases in major commodity prices during the pandemic, which have since fallen in the past year.

USDA predicts farm income to be down another 25% in 2024. There is also a significant climb in farms using conservation practices like no-till and cover crops with an increase of about 200,000 acres statewide.

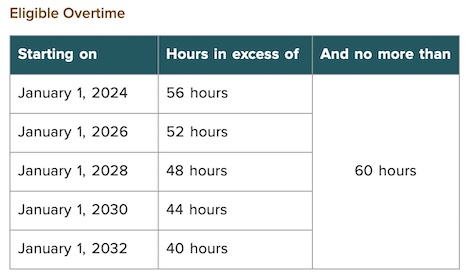

Another significant increase is farm costs. Every production expense saw a rise, from fertilizer and fuel to seed and lease prices. The biggest increase in production expenses is labor, which saw an astounding 41 percent jump in five years. This is not surprising with the surge in wage rates and overtime expenses on farms in New York. Employment increased slightly with about 1,000 new farmworkers in the state totaling 56,678 employees.

“The numbers do not come as a surprise but should be a renewed wakeup call for the state,” said David Fisher, president of New York Farm Bureau. “As we continue to see the decline in the number of farm families, we must do all that we can to reduce regulatory costs and expand market opportunities. New York Fam Bureau has stressed that the costlier it is to do business in this state, the harder it is for farms to stay in business. The loss of farmland and food production has major impacts on the economy and quality of life for all New Yorkers. We must work together to reverse this trend, include passing a strong Farm Bill that supports New York’s diverse agriculture.”

Additional NYS numbers in the 2022 USDA Ag Census:

- 30,650 farms in New York, down from 33,438 in 2017.

- 6,502,286 acres in production, down from 6,866,171 in 2017.

- Average farm size is 212 acres, up from 205 acres in 2017.

- The average net farm income of $76,281 per farm is slightly below the national average.

- 21,894 female producers and 35,664 male producers

- The average producer age is 56.7 years old, up from 55.8.

- 6,335 farmers under the age of 35, a drop from 6,718 producers in 2017.

Editor’s Note: In Orleans County, sales for farm products totaled $233.6 million in 2022, up 50.4 percent from the $155.3 million in 2017, a growth of $78.3 million. That includes sales of fruit, vegetables, milk, livestock and other farm products.

A snapshot of Orleans County’s ag economy in 2022 includes:

- 444 farms (498 in 2017)

- 130,055 land in agriculture (129,573 in 2017)

- average size of farm – 293 acres (260 in 2017)

- estimated value of land and buildings – $1.416 billion

- 33 farms at more than 1,000 acres, but 140 are 10 to 49 acres, and 131 are 50 to 179 acres.

- 132 farms sold less than $2,500, while 126 sold $100,000 or more.

Orleans County saw a big jump in farm revenue in the 2022 census, and the county’s $233.6 million puts it as the 15th-leading county in the state for ag revenue.

Orleans County saw a big jump in farm revenue in the 2022 census, and the county’s $233.6 million puts it as the 15th-leading county in the state for ag revenue.

The Farm Employer Overtime Credit is a refundable tax credit available for eligible farm employers who pay overtime wages after January 1, 2024, based on the gradual phase-in of the overtime threshold in New York State. Farmers can apply for this refundable credit if they or their business:

The Farm Employer Overtime Credit is a refundable tax credit available for eligible farm employers who pay overtime wages after January 1, 2024, based on the gradual phase-in of the overtime threshold in New York State. Farmers can apply for this refundable credit if they or their business: