Mayor reminds Medina senior citizens of expanded income eligibility for tax exemptions

Press Release, Medina Mayor Marguerite Sherman

This exemption is the result of the Village of Medina taking action under Section 467 of the New York State Real Property Tax Law, which authorizes municipal corporations to enact a local law granting up to a 50 percent property tax exemption for qualifying homeowners 65 years of age and older.

The Village’s Local Law was officially filed with the New York State Department of State on March 19, 2024, reinforcing Medina’s commitment to affordability for seniors.

The exemption provides meaningful, income-based tax relief for seniors living on fixed or limited incomes.

Senior Property Tax Exemption highlights include:

- Available to homeowners age 65 and older

- Authorized under Section 467 of the Real Property Tax Law

- Based on annual household income, including Social Security and retirement benefits

- Income limit to qualify: $24,700

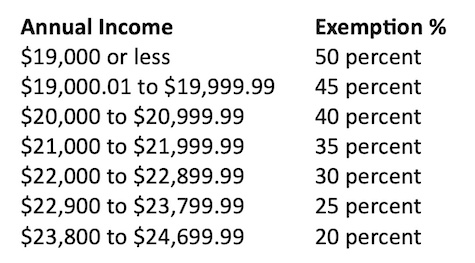

- Graduated tax exemptions ranging from 20% to 50%, depending on income level

The property must be the owner’s primary legal residence, used exclusively for residential purposes, and owned for at least 12 consecutive months.

Applications must be filed with the Village Treasurer’s Office by the taxable status date of March 1.

“Our seniors are feeling the pressure of higher prices everywhere – from groceries to utilities,” said Marguerite Sherman, mayor of the Village of Medina. “By taking action under Section 467, the Village is using every tool available to help ease that burden and ensure residents can afford to stay in the homes and community they love.”

Sherman emphasized that affordability must remain a priority as costs continue to rise.

“Affordability isn’t a buzzword – it’s a responsibility,” she added. “This exemption reflects deliberate action to support seniors and protect longtime residents from being priced out of Medina.”

Eligible residents are encouraged to pick up a form at the Village Clerk’s office, the Town of Ridgeway Assessor’s office, or on either website. Residents must file the application with the Assessor’s office by March 1, 2026.